OANDA Review

OANDA can be summarised as a trustworthy broker that offers 0% deposit and withdrawal fees, low spreads, and a sign-up bonus of up to $25 / 25 737 RWP offered to first-time traders. OANDA offers three retail accounts and has a Trust Score of 91% out of 100. OANDA is currently not regulated by the Bank of Tanzania (BoT).

- Louis Schoeman

Jump to:

Regulation and Safety of Funds

Account Types and Features

Account Registration

Trading Platforms

Range of Markets

Fees

Deposits and Withdrawals

Education and Research

Affiliate Program

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 0

Regulators

ASIC, BVI, CFTC, FCA, FFAJ, FSC, IIROC, MAS, NFA

Trading Desk

Metatrader 4 and Metatrader 5

Crypto

Yes

Total Pairs

45

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

OANDA Review – 24 key points quick overview:

OANDA Overview

👉 Overall, OANDA is considered low-risk, with an overall Trust Score of 92 out of 100. OANDA is licensed by eight Tier-1 Regulators (high trust), zero Tier-2 Regulators (average trust), and two Tier-3 Regulators (low trust). OANDA offers three different retail trading accounts namely a Standard Account, Core Account, and a Swap-Free Account.

👉 OANDA accepts Tanzanian clients and has an average spread from 0.1 pips with $40 commission according to trading volume. OANDA has a maximum leverage ratio up to 1:200 and there is a demo and Islamic account available. OANDA, MT4, MT5, and TradingView platforms are supported. OANDA is headquartered in the United States and regulated by IIROC, ASIC, CFTC, NFA, FCA, FFAJ, JFSA, MAS, MFSA, and BVI FSC.

👉 OANDA was established in 1996, making it one of the oldest and biggest foreign exchange firms in the world. Forex traders may get a competitive edge in the market with the help of OANDA’s price enhancement technology.

👉 It does this to guarantee that customers always obtain the best possible pricing for the execution of their trades by sourcing the best rates from inside the liquidity pool. In addition to that, every second, the systems can examine vast amounts of commercial data.

👉 By operating in this way, OANDA ensures that forex deals are routed in an extremely intelligent manner. Additionally, it will be possible to get the best rates in the hyperactive and very volatile foreign currency market thanks to the technology.

👉 OANDA is a worldwide supplier of financial services with its headquarters in New York, United States. New York is the core of the most financially powerful metropolis in the world, and it is also the largest International Financial Centre (“IFC”) in the world.

👉 This OANDA review for Tanzania will provide local retail traders with the details that they need to consider whether OANDA is suited to their unique trading objectives and needs.

OANDA Distribution of Traders

👉 OANDA currently has the largest market share in these countries:

➡️ United States – 18.4%

➡️ Germany – 8.2%

➡️ United Kingdom – 6.9%

➡️ Canada – 3.7%

➡️ Spain – 3.3%

Popularity among traders who choose OANDA

🥇 OANDA is a global broker with a significant presence in the United States and other important markets. While many African traders rely on OANDA, it has been regarded as one of the top 50 brokers for Tanzanians.

OANDA At a Glance

| Headquartered | United States |

| Global Offices | USA, Canada |

| ✅ Governor of SEC in Tanzania | None, Benno Ndulu is the Central Bank Governor in Tanzania |

| ✔️ Accepts Tanzanian Traders? | Yes |

| 🗓 Year Founded | 1996 |

| 📞 Tanzanian Traders Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook • YouTube |

| ⚖️ Regulation | IIROC, ASIC, CFTC, NFA, FCA, FFAJ, JFSA, MAS, MFSA, BVI FSC |

| 1️⃣ Tier-1 Licenses | • Investment Industry Regulatory Organization of Canada (IIROC) • The Australian Securities and Investments Commission (ASIC) • The Commodity Futures Trading Commission (CFTC) • National Futures Association (NFA) • Financial Conduct Authority (FCA) • Financial Futures Association of Japan (FFAJ) • Japanese Financial Services Authority (JFSA) • Monetary Authority of Singapore (MAS) |

| 2️⃣ Tier-2 Licenses | None |

| 3️⃣ Tier-3 Licenses | • Malta Financial Services Authority (MFSA) • British Virgin Islands Financial Services Commission (BVI FSC) |

| 🪪 License Number | • IIROC • Australia – ABN 26 152 088 349, AFSL No. 412981 • United States – NFA ID 0325821 • United Kingdom – 542574 • Japan (FFAJ) – 1571 • Japan (JFSA) – FIBO 2137 • Singapore – 200704926K • Malta – VLT1455 • British Virgin Islands – 2026433 |

| ⚖️ BoT Regulation | None |

| 💸 Regional Restrictions | None indicated |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 3 |

| ✔️ PAMM Accounts | No |

| 📊 Liquidity Providers | JP Morgan, Deutsche Bank, Royal Bank of Canada |

| 💰 Affiliate Program | Yes |

| 📉 Order Execution | Market |

| 📈 Starting spread | 0.1 pips |

| 📉 Minimum Commission per Trade | From $40 |

| 💸 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 50% |

| 📊 Minimum Trade Size | 0.01 lots |

| 📉 Maximum Trade Size | 1,000 lots |

| 📈 Crypto trading offered? | No |

| ✅ Offers a TZS Account? | No |

| ✔️ Dedicated Tanzanian Traders Account Manager? | No |

| ⬆️ Maximum Leverage | 1:200 |

| 📈 Leverage Restrictions for Tanzania? | No |

| 📉 Minimum Deposit (TZS) | 0 Tanzanian Shilling |

| 💵 Tanzanian Shilling Deposits Allowed? | Yes |

| 📱 Active Tanzanian Trader Stats | 50,000+ |

| 👥 Active Tanzanian-based OANDA customers | Unknown |

| 🔄 Tanzania Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Local Transfers • Debit Cards • Credit Cards • Bank Wire • Bank Transfers • Skrill • Neteller • Mobile Bank Transfers • International e-Wallets |

| 📉 Minimum Withdrawal Time | 1 business day |

| 📈 Maximum Estimated Withdrawal Time | 7 to 10 business days |

| 💵 Instant Deposits and Instant Withdrawals? | No |

| ✔️ Segregated Accounts with Tanzanian Banks? | No |

| 💻 Trading Platforms | • MetaTrader 4 • MetaTrader 5 (BVI Website) • OANDA Platform • TradingView |

| 📉 Tradable Assets | • Index CFDs • Forex • Metals • Commodity CFDs • Bonds CFDs • Precious Metals • Real-time Rates |

| 💰 Offers USD/TZS currency pair? | No |

| 📊 USD/TZS Average Spread | N/A |

| ✅ Offers Tanzanian Stocks and CFDs | No |

| ✔️ Languages supported on the Website | English, Chinese (Traditional), Spanish, Portuguese |

| 📱 Customer Support Languages | Multilingual |

| ✔️ Copy Trading Support | Yes |

| 👥 Customer Service Hours | 24/5 |

| 📞 Tanzanian-based customer support? | No |

| 💵 Bonuses and Promotions for Tanzanian Traders | Yes |

| 📚 Education for Tanzania beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🗣 Most Successful Tanzanian Trader | Unknown |

| ✅ Is OANDA a safe broker for Tanzanian Traders? | Yes |

| ✔️ Rating for OANDA Tanzania | 8/10 |

| 🥇 Trust score for OANDA | 92% |

| 👉 Open An Account | 👉 Open Account |

OANDA Regulation and Safety of Funds

OANDA Regulation in Tanzania

👉 OANDA is a company that is well known all over the world, yet it is not subject to any restrictions or has been authorized locally in Tanzania. Traders from Tanzania are welcome to use the offshore organizations that are linked with OANDA.

OANDA Global Regulations

👉 OANDA is headquartered in the United States and has offices in Canada, Australia, the United States, the United Kingdom, Japan, Singapore, Malta, and the British Virgin Islands. While OANDA is not regulated by the Bank of Tanzania (BoT), OANDA is regulated through its several global entities in the following way:

➡️ OANDA (Canada) Corporation ULC is based in Canada and is subsequently overseen and regulated by the reputable Investment Industry Regulatory Organization of Canada (IIROC).

➡️ OANDA Australia Pty Ltd. is registered in Australia under ABN 26 152 088 349 and holds AFSL number 412981 through the Australian Securities and Investments Commission (ASIC).

➡️ OANDA Corporation is a Retail Foreign Exchange Dealer licensed by the Commodity Futures Trading Commission (CFTC). In addition, OANDA Corporation is also a National Futures Association (NFA) member with NFA ID 0325821.

➡️ OANDA Europe Limited is registered in England under 7110087, regulated and overseen by the Financial Conduct Authority (FCA) under license 542574.

➡️ OANDA Japan Co., Ltd. is registered in Japan as a Financial Instruments Business Director and subsequently regulated by the Financial Futures Association of Japan (FFAJ) under subscriber number 1571.

➡️ OANDA Japan, Inc. is registered in Japan and regulated by the Japanese Financial Services Authority (JFSA) under FIBO number 2137.

➡️ OANDA Asia Pacific Pte Ltd. is licensed in Singapore under 200704926K as a Capital Market License holder, regulated by the Monetary Authority of Singapore (MAS).

➡️ OANDA Europe Markets Limited is based in Malta and holds licensing and authorization with the Malta Financial Services Authority (MFSA) under C95813.

➡️ OANDA Global Markets Ltd. is a British Virgin Islands-based entity that is regulated by the British Virgin Islands Financial Services Commission (BVI FSC) under 2026433.

OANDA Client Fund Security and Safety Features

👉 According to specific legislative requirements, it is mandatory for OANDA to provide regulatory authorities with financial information and to keep a certain amount of capital reserves, or the broker could lose its licenses and regulation. OANDA’s financial accounts are frequently audited by a reputable accounting company that is based outside the United States.

👉 According to the requirements of strict market regulators, all client funds are held at top-tier banking institutions and can only be withdrawn in connection with their trading activity or withdrawal requests.

👉 To make global currency and CFD markets more liquid, OANDA collaborates with some of the world’s leading banks and financial organizations.

👉 By using robust and innovative risk management technology, OANDA can subsequently net aggregate customer holdings automatically and anonymously, and the broker quickly hedges outstanding aggregated positions with partner banks when aggregated holdings exceed defined criteria.

Min Deposit

USD 0

Regulators

ASIC, BVI, CFTC, FCA, FFAJ, FSC, IIROC, MAS, NFA

Trading Desk

Metatrader 4 and Metatrader 5

Crypto

Yes

Total Pairs

45

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

OANDA Awards and Recognition

👉 OANDA has accumulated an enormous range of awards for its comprehensive trading services and solutions, including Best Education Materials, No. 1 Forex Broker in Singapore, Most Popular Broker, Best Forex and CFD Broker, and many more.

OANDA Account Types and Features

👉 OANDA satisfies the varied requirements of several types of traders by providing them with a choice between three distinct retail investor accounts. These accounts not only allow you access to advanced financial instruments, but they also provide you protection against negative balances, access to OANDA’s Market Pulse, and a few other additional benefits.

👉 These are the accounts that are offered to Tanzanian clients:

➡️ Standard Account

➡️ Core Account

➡️ Swap-Free Account

| 💻 Live Account | 📉 Minimum Dep. | 📊 Average Spread | 💸 Commissions | 💰 Average Trading Cost |

| ➡️ Standard | 0 TZS | 1 pip | None, spread | 10 USD |

| ➡️ Core | 0 TZS | 0.1 pip | $40 per million | 6 USD |

| ➡️ Swap-Free | 0 TZS | 1.6 pips | None, spread | 16 USD |

OANDA Live Trading Accounts

Standard Account

👉 This is the entry-level, basic account that is ideal for most Tanzanian traders who want exposure to several financial markets. The Standard Account is commission-free, and the broker’s fee is already included in the spread that is charged.

| Account Feature | Value |

| ✔️ Full Account Verification Needed? | No, not for account deposits under 20,000,000 TZS or an equivalent to $9,000 |

| 📊 Average Spreads | Variable, from 1 pip |

| 💰 Commissions (Per 1 mil traded) | None |

| 💵 Maximum Leverage | 1:200 |

| 💸 Minimum lot size | 0.01 lots |

| 🔧 Instruments | 81 |

| 🛑 Stop-Out | 50% |

| ✅ One-Click Trading offered? | Yes |

| ✔️ Strategies allowed | All |

| 💵 Base Account Currency | USD, EUR, HKD, SGD |

Core Account

👉 Because of its lower spreads and more favourable conditions, the Core Account is well suited for professional advisors, day traders, high-frequency traders, algorithmic traders, and any other short-term trader.

| Account Feature | Value |

| ✔️ Full Account Verification Needed? | No, not for account deposits under 20,000,000 TZS or an equivalent to $9,000 |

| 📊 Average Spreads | Variable, from 0.1 pips |

| 💰 Commissions (Per 1 mil traded) | 40 USD |

| 💵 Maximum Leverage | 1:200 |

| 💸 Minimum lot size | 0.01 lots |

| 🔧 Instruments | 81 |

| 🛑 Stop-Out | 50% |

| ✅ One-Click Trading offered? | Yes |

| ✔️ Strategies allowed | All |

| 💵 Base Account Currency | USD, EUR, HKD, SGD |

Swap-Free Account

👉 Muslim traders who follow the Sharia law need halal trading conditions where they do not receive or pay interest, as part of their religion. OANDA offers Muslim traders a specific account that can meet their needs while satisfying any trading objectives and needs that they have in competitive financial markets.

| Account Feature | Value |

| ✔️ Full Account Verification Needed? | No, not for account deposits under 20,000,000 TZS or an equivalent to $9,000 |

| 📊 Average Spreads | Variable, from 1.6 pips |

| 💰 Commissions (Per 1 mil traded) | None |

| 💵 Maximum Leverage | 1:200 |

| 💸 Minimum lot size | 0.01 lots |

| 🔧 Instruments | 26 |

| 🛑 Stop-Out | 50% |

| ✅ One-Click Trading offered? | Yes |

| ✔️ Strategies allowed | All |

| 💵 Base Account Currency | USD |

OANDA Base Account Currencies

👉 When Tanzanians register an OANDA trading account, they can only choose between USD, SGD, HKD, and EUR as the base currency and not TZS.

👉 It is crucial to highlight, however, that investors who trade in large volumes (more than 10 lots per month) should open an account with a digital currency bank denominated in US dollars. This is particularly important for Tanzanian traders who trade assets like the EUR/USD currency pair.

👉 This is because when trading a USD quoted currency pair with another currency account, a tiny currency conversion fee is charged to each transaction conducted.

OANDA Demo Account

👉 A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

👉 Trading on financial markets exposes investors to a certain level of risk. However, OANDA provides its customers with a risk-free trading account on which they can test trading strategies, engage in simulated trading, and investigate the services provided by the broker in a protected setting that simulates actual market conditions.

👉 OANDA makes available an unlimited number of demo accounts, which are perfect for putting novel trading strategies and solutions to the algorithmic trading test.

OANDA Islamic Account

👉 Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

👉 This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

👉 OANDA gives Muslim investors access to a customized account by providing a Swap-Free live trading account that comes with several specific additional features as well as trading limitations. It is reasonable for Muslim traders in Tanzania to anticipate receiving any or all the following benefits from their Islamic accounts:

➡️ A range of tradable markets

➡️ Up to 1:200 leverage if the account is registered through OANDA in the British Virgin Islands.

➡️ One-click trading, comprehensive charting, research, education, and more.

➡️ Variable spreads that change according to the financial instrument and market conditions, starting from 1.6 pips on major currency pairs such as EUR/USD, the most popular tradable instrument.

➡️ The ability to employ any trading strategies, given that they do not influence or manipulate the platform.

How to open an Account with OANDA in Tanzania

👉 While the online registration process is fast, OANDA requires more personal information than other brokers.

👉 The client onboarding process has been upgraded by OANDA Global Markets, a British Virgin Islands subsidiary. Subsequently, for deposits of up to $9,000, most consumers can begin trading without completing the KYC process in which traders must verify their identity and residential address.

👉 To register an account with OANDA, Tanzanian Traders can follow these steps:

➡️ To access the account registration page, new traders must first click the “Start Trading” button at the top of the website.

➡️ The OANDA registration form requests that consumers select their country of residence and provide personal, residential, and contact information as part of the seven-phase application.

➡️ Customers must then provide identification or their tax number to prove their citizenship.

➡️ The next stage needs traders to validate their residence address.

➡️ Finally, traders must submit their employment details and source of income.

➡️ Traders who deposit less than USD 9,000 are exempt from providing verification documents.

FBS Vs BD Swiss Vs Fidelity Investments – Broker Comparison

| 🥇 OANDA | 🥈 Admirals | 🥉 OspreyFX | |

| 📱 Trading Platform | IIROC, ASIC, CFTC, NFA, FCA, FFAJ, JFSA, MAS, MFSA, BVI FSC | FCA, ASIC, CySEC, EFSA, JSC, FSCA | None |

| 💵 Withdrawal Fee | • MetaTrader 4 • MetaTrader 5 • OANDA Platform • TradingView | • MetaTrader 4 • MetaTrader 5 • Admirals Mobile App | • MetaTrader 4 • MetaTrader 5 |

| 💻 Demo Account | Yes, bank wire | No | Yes |

| 💸 Min Deposit | 0 TZS | 2,300 TZS | 58,000 TZS |

| 📉 Leverage | 1:200 | • 1:30 Retail • 1:500 Professional | 1:500 |

| 📊 Spread | Variable, from 0.1 pips | From 0.0 pips | From 0.4 pips |

| 💰 Commissions | $40 | From $0.02 | From $1 |

| 🛑 Margin Call/Stop-Out | 100%/ 50% | 100%/50% | 100%/70% |

| 📱 Order Execution | Market | Market, Exchange | Market |

| ✔️ No-Deposit Bonus | No | No | No |

| 💵 Cent Accounts | No | No | No |

| 💻 Account Types | No | No | • Brokerage Account • Cash Management Account • Brokerage and Cash Management • The Fidelity Account for Businesses • Fidelity Go, and several others |

| ⚖️ BoT Regulation | • Standard Account • Core Account • Swap-Free Account | • Trade.MT5 • Invest.MT5 • Zero.MT5 • Bets.MT5 • Trade.MT4 • Zero.MT4 | • Standard Account • PRO Account • VAR Account • Mini Account |

| 💰 TZS Deposits | No | No | No |

| ✔️ Tanzanian Shilling Account | Yes | Yes | No |

| 📞 Customer Service Hours | 24/5 | 24/5 | 24/7 |

| 🛍 Retail Investor Accounts | 3 | 6 | 4 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 💵 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots | Depends on available funds | Depends on the instrument |

| 📉 Minimum Withdrawal Time | 1,000 lots | 200 lots | 1,000 lots |

| 💸 Maximum Estimated Withdrawal Time | 1 business day | Instant | Instant |

| 💰 Instant Deposits and Instant Withdrawals? | 7 to 10 business days | Between 3 to 5 working days | Up to 3 hours |

Min Deposit

USD 0

Regulators

ASIC, BVI, CFTC, FCA, FFAJ, FSC, IIROC, MAS, NFA

Trading Desk

Metatrader 4 and Metatrader 5

Crypto

Yes

Total Pairs

45

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

OANDA Trading Platforms

👉 OANDA’s technology and software offerings are intended to develop and offer the best approach for protecting the client and their transactions. Therefore, OANDA aims to offer tight and competitive spreads, distinct platforms across premium offers, and trading approach automation.

👉 OANDA offers Tanzanian Traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5 (BVI Website)

➡️ OANDA Platform

➡️ TradingView

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ OANDA Platform

MetaTrader 4

👉 Even though the broker has made its own trading platform, OANDA has one of the best MT4 upgrade packages with 28 plug-ins. MetaTrader 4 (MT4) is an option for people who do not want to use the OANDA platform. The MetaTrader 4 platform from OANDA has excellent features that make it the best choice for forex traders.

👉 The package comes with trading algorithms and backtesting features, and professional traders and advisors who can hedge get full support. The MT4 Order Book Indicator is one of more than 50 technical indicators that traders can use to trade right from the charts.

👉 MT4 Plug-In has tools like intraday market scanning, automated chart pattern recognition, and trade automation. In addition, another helpful feature is that AutoChartist also sends traders regular market reports.

MetaTrader 5

👉 With OANDA, you can use the MetaTrader 5 platform’s strong features as well as other features like built-in depth of market, advanced trading tools, and improved charting capabilities.

👉 When Tanzanian traders use OANDA and MetaTrader 5, they can expect some of the following additional features and capabilities:

➡️ Robust technical system capacity

➡️ There are 21 charting periods

➡️ Six order times that allow traders to manage and modify positions

➡️ You can use MQL5 to create Expert Advisors, technical indicators, and more

➡️ 38 technical indicators and 44 analytical objects are built into the platform

➡️ The ability to trade and analyse a wide range of financial instruments across several asset classes

➡️ Threaded technology that works well at high speed

OANDA Platform

👉 Several awards have been bestowed on OANDA’s “next-gen” platform. It has several tools that may be used for trade management, advanced charting, and market analysis. The platform’s trading environment is pleasant and flexible to traders of varying levels of skill.

👉 Because the online version operates entirely inside the browser, it is compatible with all operating systems and most modern web browsers regardless of whether it is on a computer or a mobile device, given that traders have a steady internet connection.

👉 OANDA Forex Labs is an extra service created by OANDA. It is a one-of-a-kind institution that does innovative research and displays Forex Analysis, Signals, and FX Tools as part of a continuous improvement process.

👉 There is also the possibility to try out the beta version of the latest tools and capabilities.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ OANDA Platform

➡️ TradingView

MetaTrader 4

👉 Trading foreign currency (Forex) using the MT4 trading platform is by far the most popular approach accommodated by most brokers including OANDA, and it also has the capacity of being used to trade other things, such as commodities, cryptocurrencies, stock indexes, and stock CFDs.

👉 Even though it is starting to exhibit signs of its age, MT4 is still frequently utilized due to the auto trading features that it provides. Because of these qualities, it is feasible to participate in algorithmic trading and to do strategy backtesting with the assistance of qualified advisors (trading robots).

MetaTrader 5

👉 MetaTrader 5 is an improved and more sophisticated version of MetaTrader 4 that provides traders with new capabilities and features. MetaTrader 5 is accessible through most internet browsers, enabling traders to control and monitor their trading operations in real-time.

👉 Below are some typical MetaTrader features that Tanzanians can expect:

➡️ With the depth of market, you may trade huge quantities in a single transaction and monitor prices and spreads for greater volumes.

➡️ Because the economic calendar is already included in MT5 for OANDA, you will find it much easier to keep track of upcoming events and market-related news indicators.

➡️ You have unlimited access to the one-click trading tool and the market depth, allowing you to buy and sell instruments directly from the charts.

➡️ Create your own expert advisers to automate your trading strategy using the MQL5 programming language.

➡️ Explore the third-party market without leaving the MT5 client interface.

➡️ Develop your own unique technical indicators for market analysis. You may backtest your trading strategies as well as other things.

➡️ Conduct a market scan and analysis during the intraday trading session using the automatic chart pattern discovery tool.

OANDA Platform

👉 OANDA’s online platform may be accessed through any browser, regardless of the operating system of the computer or mobile device, if the trader has a consistent internet connection. Some of the usual features of the OANDA Web-based platform are as follows:

➡️ Advanced technical analysis capabilities, with over 10 distinct chart types to select from.

➡️ When doing chart analysis, more than fifty different drawing tools and technical indicators are accessible.

➡️ A comprehensive news aggregator that incorporates a search function.

➡️ Algo Labs allows you to access algorithmic trading.

➡️ The risk management features include a stop-loss function.

➡️ A tool for analysing trading performance.

➡️ Modifiable layouts and user interfaces.

➡️ TradingView forms part of this offer and has excellent charting tools.

➡️ Traders may access market news, research, and an economic calendar.

TradingView

👉 Most of the functionality that is accessible in the downloaded version of OANDA’s platform is also available in the web-based version of OANDA’s platform. This functionality includes charts from TradingView that are comprised of sophisticated studies and presentation styles.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ OANDA Platform

MetaTrader 4 and 5

👉 OANDA offers support for the mobile trading apps MT4 and MT5, both of which are available for free download on iOS and Android smartphones.

👉 The capability of mobile trading platforms is limited in comparison to that of desktop trading platforms, and Tanzanian traders should be aware of this limitation so that they can plan their trading activities around it.

👉 Traders are still able to cancel and alter existing orders, compute profit and loss, and trade on the charts, despite this reduction in functionality, which includes fewer charting choices and timeframes.

OANDA Platform

👉 OANDA’s mobile solution is an extension of its user-friendly desktop platform. The OANDA mobile app, like the desktop platform, is fully capable of conducting all trading activities. Here are some of the top OANDA mobile app features:

➡️ Complete charting capabilities. OANDA’s mobile solution does not scrimp on charting features; rather, it duplicates the entire range of services available on its desktop platform.

➡️ You can enhance your trading by opting for 9 diverse types of charts, obtaining access to over 50 distinct technical indicators, and charting tools, easily modifying multiple orders, and using over 32 overlays.

➡️ Examine the analytics’ performance. OANDA’s performance statistics allow you to track the evolution of your forex trading gains and losses over time. View a breakdown of trading performance by instrument, including total and average per-trade profits and losses, as well as other data that may help you improve and alter your strategy over time.

➡️ Real-time updates on market news. OANDA’s market news stream offers consumers real-time information about current events as well as expert commentary from market analysts.

➡️ By refreshing your news stream, you can see how many minutes have elapsed since each piece was published.

➡️ The smartphone software also has an economic calendar that details upcoming market events.

OANDA Range of Markets

👉 Tanzanian Traders can expect the following range of markets from OANDA:

➡️ Index CFDs

➡️ Forex

➡️ Metals

➡️ Commodity CFDs

➡️ Bonds CFDs

➡️ Precious Metals

➡️ Real-time Rates

Financial Instruments and Leverage offered by OANDA

| 🔨 Instrument | ✔️ Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 70+ | 1:200 |

| ➡️ Precious Metals | 5 | 1:200 |

| ➡️ Indices | 16 | 1:200 |

| ➡️ Energies | 3 | 1:200 |

| ➡️ Bonds | 5 | – |

| ➡️ Agricultural Commodities | 5 | 1:100 |

Broker Comparison for Range of Markets

| 🥇 OANDA | 🥈 Admirals | 🥉 OspreyFX | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | Yes | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | No | Yes | Yes |

| ➡️️ Bonds | Yes | Yes | Yes |

OANDA Trading and Non-Trading Fees

Spreads

👉 OANDA is well-known for offering competitive spreads on a wide range of financial goods. According to OANDA, there are times during market hours when spreads could be higher, such as when markets open and close, and when significant international or geopolitical events occur.

👉 Some of the typical spreads that Tanzanians can expect on EUR/USD are as follows:

➡️ Standard Account – from 1 pip

➡️ Core Account – from 0.1 pips

➡️ Swap-Free Account – from 1.6 pips

Commissions

👉 Tanzanian traders who utilize the Standard or Swap-Free Account pay no fees on their transactions since OANDA’s fee to facilitate the trade is already included in the spread. Because the Core Account has narrower spreads, a commission charge of $40 is levied on each 1 million of the base currency exchanged.

Overnight Fees, Rollovers, or Swaps

👉 When Tanzanian traders keep a position open for longer than 24 hours, they incur an overnight fee. This fee is either deducted or refunded depending on the position that they hold.

👉 Muslim traders who use a Swap-Free account are not subject to this fee, but there are admin fees that apply to Swap-Free trading if positions are held open for longer than 5 days.

👉 Apart from the Japan 225 Index, which is paid per 100 lots traded, traders using the Swap-free account may trade 26 popular items, but they must pay fees ranging from $4 to $7 for each lot. A Muslim trader who holds a position open for more than five days will be charged these costs.

👉 Overnight expenditures on forex pairs are estimated by averaging the underlying liquidity providers’ tom-next SWAP rates, compensating for the instrument-specific admin charge, and then annualizing the findings.

👉 Rates include a 2.5% administrative charge as well as the appropriate annual financing rate based on indices. This is portrayed as a negative rate, implying that the fees are subtracted.

👉 The average overnight rate for major currencies such as EUR/USD is -2.03% long and -0.03% short. This equates to a -$6.36 long position and a -$0.09 short position.

Deposit and Withdrawal Fees

👉 When Tanzanians deposit funds into their OANDA trading account they can do so without incurring any deposit fees. However, if withdrawals are made using bank wire transfer, there is a $20 fee charged.

Inactivity Fees

👉 If a trading account becomes dormant and remains inactive for a consecutive 12 months, there is an inactivity fee that will be deducted from the trading account balance. Once the account has become dormant, a fee of 10 units of the account’s base currency will be deducted monthly until the balance reaches zero. Once this happens, the account will be terminated automatically.

Currency Conversion Fees

👉 When Tanzanian traders deposit or withdraw funds to/from the trading account in any currency other than the accepted account currencies, they are charged a conversion fee.

Min Deposit

USD 0

Regulators

ASIC, BVI, CFTC, FCA, FFAJ, FSC, IIROC, MAS, NFA

Trading Desk

Metatrader 4 and Metatrader 5

Crypto

Yes

Total Pairs

45

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

OANDA Deposits and Withdrawals

👉 OANDA offers the following deposit and withdrawal methods:

➡️ Local Transfers

➡️ Debit Card

➡️ Credit Card

➡️ Bank Wire

➡️ Bank Transfers

➡️ Skrill

➡️ Neteller

➡️ Mobile Bank Transfers

➡️ International e-Wallets

Broker Comparison: Deposit and Withdrawals

| 🥇 OANDA | 🥈 Admirals | 🥉 OspreyFX | |

| Minimum Withdrawal Time | 1 business day | Instant | Instant |

| Maximum Estimated Withdrawal Time | 7 to 10 business days | Between 3 to 5 working days | Up to 3 hours |

| Instant Deposits and Instant Withdrawals? | No | Yes | Yes |

OANDA Payment Method, Deposit and Withdrawal Processing

| 💰 Payment Method | 💵 Deposit Processing | 💸 Withdrawal Processing |

| Local Transfers | 1 business day | 1 to 10 business days |

| Debit Card | 1 business day | 1 to 10 business days |

| Credit Card | 1 business day | 1 to 10 business days |

| Bank Wire | 1 business day | 1 to 10 business days |

| Bank Transfers | 1 business day | 1 to 10 business days |

| Skrill | 1 business day | 1 to 10 business days |

| Neteller | 1 business day | 1 to 10 business days |

| Mobile Bank Transfers | 1 business day | 1 to 10 business days |

| International e-Wallets | 1 business day | 1 to 10 business days |

How to Deposit Funds with OANDA

👉 To deposit funds to an account with OANDA, Tanzanian Traders can follow these steps:

➡️ Log in to the OANDA site and choose “Fund Account” from the dashboard.

➡️ A new menu will appear, allowing you to choose your chosen deposit method.

➡️ From here, you may continue by inputting your deposit amount and completing any extra steps that your selected payment provider may demand, enabling you to confirm and complete the deposit.

OANDA Fund Withdrawal Process

👉 To withdraw funds from an account with OANDA, Tanzanian Traders can follow these steps:

➡️ Log in to your OANDA portal to access your trading account.

➡️ Select “Withdrawal” or “Withdraw money” from the applicable drop-down list.

➡️ Select the method of withdrawal and/or the account to which the monies will be sent (if more than one option is available).

➡️ Enter the amount you want to withdraw, as well as a short reason or explanation if one is needed.

➡️ Send your withdrawal request to OANDA for processing.

OANDA Education and Research

Education

👉 OANDA is a broker that provides training materials and webinars adapted to the participant’s level of skill, ranging from beginner to expert, which is why both novice and experienced traders pick OANDA.

👉 OANDA provides the following educational resources:

➡️ Introduction to Trading Analysis

➡️ Introduction to the trading platforms

➡️ Introduction to Capital Management

➡️ Live and Recorded Webinars

Research and Trading Tool Comparison

| 🥇 OANDA | 🥈 Admirals | 🥉 OspreyFX | |

| Economic Calendar | Yes | Yes | No |

| VPS | Yes | Yes | No |

| AutoChartist | Yes | No | No |

| Trading View | Yes | No | No |

| Trading Central | No | Yes | No |

| Market Analysis | Yes | Yes | Yes |

| News Feed | Yes | Yes | Yes |

| Blog | Yes | Yes | Yes |

👉 OANDA offers research that is formulated in-house on the MarketPulse blog, and some of which is conducted in partnership with sources outside of OANDA. The following resources are made available to clients, in addition to daily market analysis:

➡️ MetaTrader Premium Tools

➡️ Technical analysis offered by AutoChartist

➡️ VPS

➡️ Economic Calendar

OANDA Bonuses and Promotions

👉 OANDA offers Tanzanian Traders the following bonuses and promotions:

➡️ A $1,000 welcome bonus on your first deposit when you open a retail trading account with OANDA. Existing customers who have an account but have not yet deposited cash are also eligible for this incentive.

➡️ A $1,000 referral bonus for both the recommending trader and their referrer. Referrals must open an OANDA Global Markets Account via the BVI business and deposit at least $200 to qualify. Furthermore, within 30 days of registration, the referral must trade a notional volume of 200,000 units of the base currency (two standard lots). The recommending trader and referral might earn more on this incentive if the referral deposits more money and trades at a larger volume.

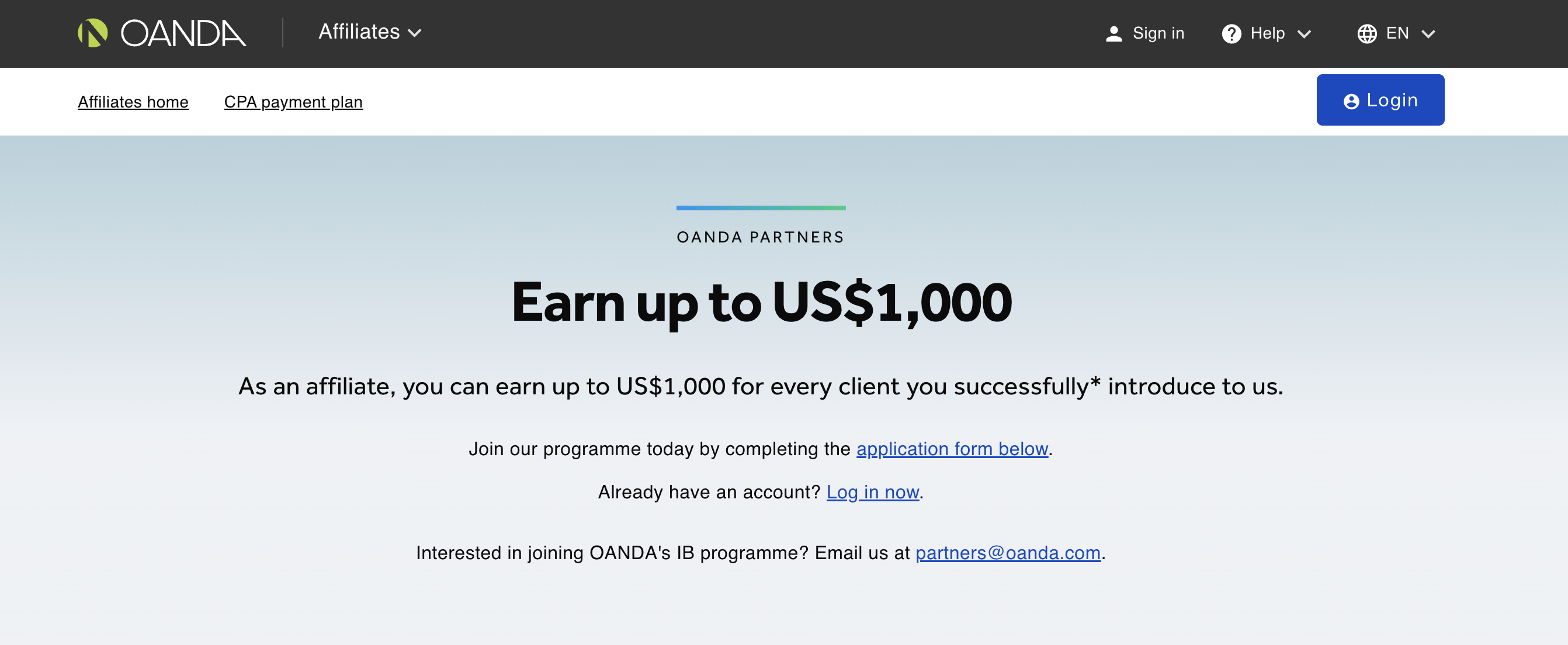

How to open an Affiliate Account with OANDA

👉 To register an Affiliate Account, Tanzanian Traders can follow these steps:

➡️ Go to the website of OANDA and go to the Partner’s Section, which can be found under the main menu.

➡️ First, go over the Affiliate Terms and Conditions, then fill out the application form that loads with all the relevant information, and finally, submit the form.

➡️ You may also sign up for the affiliate program by sending an email to the Partners department at OANDA.

OANDA Affiliate Program Features

👉 The OANDA partner program is the official affiliate program for the OANDA brand, which runs globally. It is considered one of the most effective and profitable affiliate programs in the banking industry.

👉 OANDA’s affiliate program enables partners to earn up to US$600 for each qualifying trader they bring to the company’s notice from a developing country.

👉 Each OANDA program partner is assigned a professional affiliate manager who is responsible for assisting with the platform as well as providing advice on how to strengthen their digital presence.

👉 Affiliates may also track referrals on OANDA’s revolutionary affiliate site, which provides them with a comprehensive set of marketing resources to help maximize conversion. These materials span from digital banner adverts to amazingly effective landing pages.

👉 Another advantage of the OANDA affiliate program is that partners may participate for free.

Min Deposit

USD 0

Regulators

ASIC, BVI, CFTC, FCA, FFAJ, FSC, IIROC, MAS, NFA

Trading Desk

Metatrader 4 and Metatrader 5

Crypto

Yes

Total Pairs

45

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

OANDA Customer Support

👉 OANDA offers multilingual support that can be accessed 24 hours a day, 5 days a week in several diverse ways.

| Customer Support | OANDA’s Customer Support |

| ⏰ Operating Hours | 24/5 |

| 🗣 Support Languages | English, Chinese, German, Spanish |

| 💭 Live Chat | Yes |

| 💻 Email Address | Yes |

| ☎️ Telephonic Support | No |

| 📞 Local Support in Tanzania? | No |

| 🥇 Overall quality of OANDA Support | 3.6/5 |

OANDA Corporate Social Responsibility

👉 There is no information available currently about the ongoing corporate social responsibility programs or activities in which OANDA is participating.

Our Verdict on OANDA

👉 OANDA is a trustworthy broker with a long history of business, a solid foundation, an outstanding reputation, and various rules. Due to the lack of a minimum deposit requirement and the professional education area, OANDA is ideal for novice traders.

👉 With minimal prices and spreads, a variety of trading tools, proprietary software, and industry-leading tools are supplied.

👉 Google, KPMG, TESLA, Airbnb, FedEx, IATA, Twitter, Expedia, and many more of the world’s largest companies have selected OANDA as their partner, confirming the company’s credibility and trustworthiness.

👉 OANDA’s dedication to democratizing the global financial markets has been acknowledged by industry journals and organizations with several industry awards. Annually, OANDA customers have voted the firm number one in customer service, value for money, and overall client satisfaction.

OANDA Pros and Cons

| ✔️ Pros | ❌ Cons |

| OANDA is well-regulated by eight of the best and strictest market regulators in the world | OANDA charges several ancillary fees |

| OANDA offers its services to 196 worldwide countries, proving that the broker has a truly global presence | Tanzanian traders cannot register a TZS-denominated account |

| OANDA offers an award-winning proprietary trading platform along with MT4 and 5 | There is a limited selection of funding and withdrawal options |

| OANDA’s mobile trading app is critically acclaimed and one of the best options for Tanzanian traders who trade while travelling | |

| There is a range of tradable instruments across several asset classes, giving Tanzanians a choice between trading opportunities | |

| Client fund security is guaranteed by OANDA, and investor protection is granted to EU and Canadian traders | |

| Negative balance protection is offered by many of OANDA’s entities except those in the United States | |

| Traders do not need to verify their account if they deposit less than $9,000 |

FAQ

Is OANDA regulated?

Yes, OANDA is well-regulated in the following regions by respective market regulators:

- Canada (OANDA (Canada) Corporation ULC) – Investment Industry Regulatory Organization of Canada (IIROC).

- Australia (OANDA Australia Pty Ltd.) – The Australian Securities and Investments Commission (ASIC).

- The United States (OANDA Corporation) – The Commodity Futures Trading Commission (CFTC) and The National Futures Association (NFA).

- The United Kingdom (OANDA Europe Limited) – Financial Conduct Authority (FCA).

- Japan (OANDA Japan Co., Ltd.) – Financial Futures Association of Japan (FFAJ).

- Japan (OANDA Japan, Inc.) – Japanese Financial Services Authority (JFSA).

- Singapore (OANDA Asia Pacific Pte Ltd.) – Monetary Authority of Singapore (MAS).

- Malta (OANDA Europe Markets Limited) – Malta Financial Services Authority (MFSA).

- British Virgin Islands (OANDA Global Markets Ltd.) – The British Virgin Islands Financial Services Commission (BVI FSC).

Is OANDA safe or a scam?

OANDA is a very safe broker. In terms of trust score, OANDA scores 92 out of 100 and in terms of regulatory status, OANDA is regulated by eight Tier-1 and two Tier-3 regulators, which means that OANDA is bound by several regulations and laws to guarantee client fund safety, maintain a safe trading environment, and comply with all other requirements such as providing financial reports and statements, external auditing, and so on.

Does OANDA have Nasdaq?

Yes, OANDA has Nasdaq. Nasdaq can be traded as a CFD on Indices under the symbol “NAS100”.

Can I hedge with OANDA?

Yes, when you use MetaTrader 4 you will have access to hedging capabilities.

What is the withdrawal time for OANDA?

OANDA’s withdrawals can take between one to ten business days, depending on the withdrawal method and internal bank processes.

What is the minimum lot size for OANDA?

OANDA’s smallest lot size is 0.01 lots or a micro-lot.

Does OANDA have Volatility 75?

No, VIX is not a part of OANDA’s portfolio of tradable instruments but there are several others offered.

How many units are in a lot with OANDA?

There are 100,000 units of the base currency in a standard lot with OANDA.

How do you use margin on OANDA?

The Margin Used is calculated by multiplying the position size by the Margin Requirement and averaging it across all open positions. This sum is then translated into the account’s currency at the current midway rate.

Conclusion

👉 Now it is your turn to participate:

➡️ Do you have any prior experience with OANDA?

➡️ What was the determining factor in your decision to engage with OANDA?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with OANDA such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

👉 Regardless, please share your thoughts in the comments below.