GO Markets Review

Overall, GO Markets is very competitive in terms of its trading fees and spreads. GO Markets offers 2 retail investor accounts as well as a demo account. GO Markets have over 50 000 active Tanzanian traders and have an overall Trust Score of 98% out of 100. Go Markets is currently not regulated by the Bank of Tanzania.

- Louis Schoeman

Jump to:

Regulation and Safety of Funds

Account Types and Features

Account Registration

Trading Platforms

Range of Markets

Fees

Deposits and Withdrawals

Education and Research

Affiliate Program

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 200 / 466 349 TZS

Regulators

Australian Securities & Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySec), Financial Services Commission (FSC)Financial Services Authority (FSA) & Securities and Commodities Authority (SCA)

Trading Desk

Hybrid

Crypto

Yes

Total Pairs

600+

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

GO Markets Review – 23 key points quick overview:

- ✅ GO Markets Overview

- ✅ GO Markets At a Glance

- ✅ GO Markets Regulation and Safety of Funds

- GO Markets Awards and Recognition

- GO Markets Account Types and Features

- How to open an Account with GO Markets in Tanzania

- GO Markets Vs NinjaTrader Vs ACY Securities – Broker Comparison

- GO Markets Trading Platforms

- GO Markets Range of Markets

- Broker Comparison for Range of Markets

- GO Markets Trading and Non-Trading Fees

- GO Markets Deposits and Withdrawals

- How to Deposit Funds with GO Markets

- GO Markets Fund Withdrawal Process

- GO Markets Education and Research

- GO Markets Bonuses and Promotions

- How to open an Affiliate Account with GO Markets

- GO Markets Affiliate Program Features

- GO Markets Customer Support

- GO Markets Corporate Social Responsibility

- Our Verdict on GO Markets

- GO Markets Pros and Cons

- FAQ

GO Markets Overview

👉 Overall, GO Markets is considered low-risk, with an overall Trust Score of 98 out of 100. GO Markets is licensed by one Tier-1 Regulator (high trust), one Tier-2 Regulator (average trust), and two Tier-3 Regulators (low trust). GO Markets offers two different retail trading accounts namely a Standard Account and a GO+ Account.

👉 GO Markets accepts Tanzanian clients and has an average spread from 0.0 pips with US$5 commission round turn/US$2.5 per side. GO Markets has a maximum leverage ratio up to 1:500 and there is a demo account but no Islamic Account. MT4 and MT5 platforms are supported. GO Markets is headquartered in Australia and regulated by ASIC, FSA Seychelles, FSC Mauritius, and CySEC.

👉 GO Markets is a well-regulated broker that will appeal to traders who are searching for a straightforward account structure and a comprehensive selection of trading tools on the MT4 and MT5 platforms. GO Markets is also user-friendly.

👉 GO Markets provides trading on a variety of CFDs, including foreign exchange (Forex), share CFDs, indices, metals, and commodities. Traders have the option of choosing between two accounts, both of which have competitive trading charges.

👉 The GO Plus+ ECN Account is the more desirable option between the two and GO Markets offers a comprehensive set of trading tools in addition to providing complete support for MT4 and MT5 trading platforms.

👉 Among them are a free virtual private server (VPS) service, AutoChartist, Metatrader Genesis, Trading Central, a-Quant, and the copy-trading service provided by Myfxbook.

👉 Most of these tools can be used free of charge by real account members. Traders will also be pleased to learn that they are not required to pay any additional fees to make deposits, withdrawals, or maintain dormant accounts.

👉 This GO Markets review for Tanzania will provide local retail traders with the details that they need to consider whether GO Markets is suited to their unique trading objectives and needs.

GO Markets Distribution of Traders

👉 GO Markets currently has the largest market share in these countries:

➡️ Australia – 31.5%

➡️ Philippines – 9.5%

➡️ United Kingdom – 6.8%

➡️ Viet Nam – 5.6%

➡️ Brazil – 5.3%

Popularity among traders who choose GO Markets

🥇 GO Markets, a brokerage business, is classified among the Top 50 brokers that can service Botswanan consumers, even though the company does not have a large piece of the derivatives market in Botswana.

GO Markets At a Glance

| 🏛 Headquartered | Australia |

| 🏙 Global Offices | Australia, Hong Kong, United Kingdom, Taipei |

| 🌃 Local Market Regulator in Tanzania | Bank of Tanzania (BoT) |

| ✅ Foreign Direct Investment in Tanzania | $0.99B in 2019 |

| ✔️ Foreign Exchange Reserves in Tanzania | 6.714 billion US dollars in 2021 |

| 🏛 Local office in Dodoma? | No |

| ✅ Governor of SEC in Tanzania | None, Benno Ndulu is the Central Bank Governor in Tanzania |

| ✔️ Accepts Tanzanian Traders? | Yes |

| 🗓 Year Founded | 2006 |

| 📞 Tanzanian Traders Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook • YouTube |

| ⚖️ Regulation | ASIC, FSA Seychelles, FSC Mauritius, CySEC |

| 1️⃣ Tier-1 Licenses | • Australian Securities and Investments Commission (ASIC) |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange Commission (CySEC) |

| 3️⃣ Tier-3 Licenses | • Financial Services Authority (FSA) • Financial Services Commission (FSC) |

| 🪪 License Number | • Australia – ABN 24 653 400 527, AFSL 254963 • Seychelles – SD043 • Mauritius – GB 19024896 • Cyprus – 322/17 |

| ⚖️ BoT Regulation | None |

| 💸 Regional Restrictions | USA, Canada, New Zealand, Belgium, Japan, Israel, Turkey, Vietnam, Puerto Rico, Afghanistan, Azerbaijan, Bosnia and Herzegovina, Burundi, Central African Rep, Congo, Cote D’Ivoire , Ethiopia, Eritrea, Egypt, Gaza Strip, Haiti, Iran, Iraq, Lebanon, Libya, Myanmar, North Korea, Pakistan, Serbia, Sierra Leone, Somalia, Sri Lanka, Sudan, South Sudan, Syria, Trinidad and Tobago, Tunisia, West Bank, Ukraine, Vanuatu, Venezuela, Yemen, Zimbabwe. |

| ☪️ Islamic Account | No |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 2 |

| ✔️ PAMM Accounts | No |

| 📊 Liquidity Providers | Over 22 liquidity providers |

| 💰 Affiliate Program | Yes |

| 📉 Order Execution | Instant |

| 📈 Starting spread | 0.0 pips |

| 📉 Minimum Commission per Trade | From US$2.50 |

| 💸 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 80% |

| 🛑 Stop-Out | 50% |

| 📊 Minimum Trade Size | 0.01 lots |

| 📉 Maximum Trade Size | 250 lots |

| 📈 Crypto trading offered? | No |

| ✅ Offers a TZS Account? | No |

| ✔️ Dedicated Tanzanian Traders Account Manager? | No |

| ⬆️ Maximum Leverage | 1:500 |

| 📈 Leverage Restrictions for Tanzania? | No |

| 📉 Minimum Deposit (TZS) | 320,000 TZS or equivalent to AU$200 |

| 💵 Tanzanian Shilling Deposits Allowed? | No |

| 📱 Active Tanzanian Trader Stats | 250,000+ |

| 👥 Active Tanzanian-based GO Markets customers | Unknown |

| 🔄 Tanzania Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Credit Card • Debit Card • POLi • Skrill • Neteller • Bank Wire Transfer • BPAY • Fasapay |

| 📉 Minimum Withdrawal Time | Instant |

| 📈 Maximum Estimated Withdrawal Time | 1 to 3 business days |

| 💵 Instant Deposits and Instant Withdrawals? | Yes |

| ✔️ Segregated Accounts with Tanzanian Banks? | No |

| 💻 Trading Platforms | • MetaTrader 4 • MetaTrader 5 |

| 📉 Tradable Assets | • Forex CFDs • Share CFDs • Index CFDs • Metal CFDs • Commodity CFDs |

| 💰 Offers USD/TZS currency pair? | No |

| 📊 USD/TZS Average Spread | N/A |

| ✅ Offers Tanzanian Stocks and CFDs | No |

| ✔️ Languages supported on the Website | English, Spanish, Italian, Portuguese, Arabic, Indonesian, Thai |

| 📱 Customer Support Languages | Multilingual |

| ✔️ Copy Trading Support | Yes, Myfxbook AutoTrade |

| 👥 Customer Service Hours | 24/5 |

| 📞 Tanzanian-based customer support? | No |

| 💵 Bonuses and Promotions for Tanzanian Traders | None |

| 📚 Education for Tanzania beginner traders | Yes |

| 📱 Proprietary trading software | No |

| 🗣 Most Successful Tanzanian Trader | Unknown |

| ✅ Is GO Markets a safe broker for Tanzanian Traders? | Yes |

| ✔️ Rating for GO Markets Tanzania | 8/10 |

| 🥇 Trust score for GO Markets | 98% |

| 👉 Open An Account | 👉 Open Account |

GO Markets Regulation and Safety of Funds

GO Markets Regulation in Tanzania

👉 GO Markets is not regulated in Tanzania by any local market regulators.

GO Markets Global Regulations

👉 GO Markets was established in 2006 and currently has its headquarters in Melbourne. The company is subject to regulation by the following entities:

➡️ Australian Securities and Investments Commission (ASIC)

➡️ The Cyprus Securities and Exchange Commission (CySEC)

➡️ The Seychelles Financial Services Authority (FSA)

➡️ The Financial Services Commission (FSC) of Mauritius

👉 The Australian Securities and Investments Commission (ASIC) has granted GO Markets Pty Ltd an AFSL license with the number 254963.

👉 In Mauritius, GO Markets Pty Ltd (MU) is a Global Business Company with the company number 170969, and it is licensed and regulated as an Investment Dealer by the Financial Services Commission (FSC) of Mauritius under the number GB 19024896.

👉 CySEC has granted GO Markets Ltd. authorization and regulation; the company’s license number is 322/17. GO Markets has a valid Securities Dealer Licence with the number SD043 from the Seychelles Financial Services Authority, which both authorizes and regulates the company.

GO Markets Client Fund Security and Safety Features

👉 Traders from Tanzania will be doing their business via the subsidiary known as GO Markets Pty Ltd. This company is authorized and regulated by the Financial Services Commission (FSC) of Mauritius, which enables brokers to provide more leverage to their customers.

👉 The Financial Services Commission (FSC) does not require businesses to segregate client funds, provide negative balance protection, or participate in investor schemes, in contrast to top-tier regulators such as the Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC).

👉 However, customer money is kept separate from GO Markets’ operational capital in several different top-tier financial institutions. GO Markets does not and will not utilize customer funds for its operation or any other investment, which ensures that customers’ funds are always protected.

👉 However, Tanzanian traders must note that protection against negative balances is only provided at the discretion of GO Markets under certain regulations.

👉 In addition to strict regulations, several accolades have been bestowed to GO Markets, including “Best Customer Service 2019” from Investment Trends and “Best Educational Materials/Programs 2019.” (Investment Trends).

👉 Overall, GO Markets desires to provide Tanzanian traders with a safe and secure trading environment due to its long track record of responsibility, the segregation of client money, and the prominent level of regulatory oversight, with all these factors contributing to GO Markets as a safe, transparent, and trusted trading service provider.

Min Deposit

USD 200 / 466 349 TZS

Regulators

Australian Securities & Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySec), Financial Services Commission (FSC)Financial Services Authority (FSA) & Securities and Commodities Authority (SCA)

Trading Desk

Hybrid

Crypto

Yes

Total Pairs

600+

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

GO Markets Awards and Recognition

👉 GO Markets has earned multiple industry accolades since its launch, including Best Customer Service in 2019 (given by Investment Trends) and Best Educational Materials and Programs in 2019, also awarded by Investment Trends.

GO Markets Account Types and Features

👉 There are two basic account types offered by GO Markets, and both are accessible to novice traders as well as those with more expertise. Beginner traders often do not like to take unnecessary financial risks by trading huge quantities of money, and they also typically are unable to trade full-time during the workweek due to other obligations.

👉 Beginner traders should often look for trading accounts that have lower required initial deposits and that provide them with the ability to trade in micro-lots.

👉 The spreads on both the accounts offered by brokers are typically wider than accounts with higher minimum deposits. However, this is not the case at GO Markets since the minimum deposit required for each of these accounts is 320,000 Tanzanian shilling or an equivalent to 200 AUD.

👉 The GO Plus+ Account charges variable spreads that start from 0.0 pips on major forex pairs such as EUR/USD in exchange for a fee of 6 USD (round turn) per lot that is traded.

👉 Overall, experienced traders prefer trading accounts that require a greater minimum deposit and have tighter spreads.

👉 Again, this trade-off does not take place with GO Markets since both accounts need a minimum deposit of 200 AUD, but the GO Plus+ Account has lower trading charges than the standard account.

| 💻 Live Account | 📉 Minimum Dep. | 📊 Average Spread | 💸 Commissions | 💰 Average Trading Cost |

| ➡️ Standard | 320,000 TZS or 200 AUD | 1 pip | None | 10 USD |

| ➡️ GO+ | 320,000 TZS or 200 AUD | 0.0 pips | AU$3 per side | 6 USD |

GO Markets Live Trading Accounts

Standard Account

👉 The Standard Account is a commission-free, No-dealing desk account designed for beginners and typical Tanzanian traders who use medium and long-term trading strategies. The features on the GO Markets Standard Account are as follows:

| Account Feature | Value |

| 💰 Minimum Deposit | 320,000 TZS or an equivalent to AU$200 |

| 🗣 Access to an Account Manager | Yes |

| 💵 Commission Charges | None |

| 📊 Average Spread | Variable, from 1 pip |

| 💻 Markets Offered | • 50+ FX Pairs including major, minor, and exotic pairs • Shares • Indices • Commodities • Cryptocurrencies |

| 📈 Maximum Leverage offered | 1:500 |

| 🔨 Access to Trading Tools | Yes |

| 💸 Base Account Currencies | AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD |

| ✔️ Expert Advisors | Yes |

| ✅ Scalping Allowed? | Yes |

| 📱 Free VPS offered? | Yes |

GO+ Account

👉 The GO Markets GO+ Account is suited for experienced, professional traders who use short-term trading strategies and who need the lowest spreads possible. This account type is perfect for day traders, scalpers, algorithmic traders, expert advisors, and other fast-paced trading strategies.

| Account Feature | Value |

| 💰 Minimum Deposit | 1,600 BWP or an equivalent to AU$200 |

| 🗣 Access to an Account Manager | Yes |

| 💵 Commission Charges | AU$3 per side on a standard lot |

| 📊 Average Spread | Variable, from 0.0 pips |

| 💻 Markets Offered | • 50+ FX Pairs including major, minor, and exotic pairs • Shares • Indices • Commodities • Cryptocurrencies |

| 📈 Maximum Leverage offered | 1:500 |

| 🔨 Access to Trading Tools | Yes |

| 💸 Base Account Currencies | AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD |

| ✔️ Expert Advisors | Yes |

| ✅ Scalping Allowed? | Yes |

| 📱 Free VPS offered? | Yes |

GO Markets Base Account Currencies

👉 Tanzanians who register a new GO Markets Account can choose from these base currencies:

➡️ AUD

➡️ USD

➡️ EUR

➡️ GBP

➡️ NZD

➡️ CAD

➡️ SGD

➡️ CHF

➡️ HKD

GO Markets Demo Account

👉 A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

👉 There is a certain degree of risk involved when trading financial markets and GO Markets offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

👉 Any trader would benefit from beginning their experience with a demo account. This allows you to get to know GO Markets in a trading environment in which you assume no risk at all.

👉 You can open a demo account with GO Markets for any of the account types that are offered, and you will be given a simulated trading balance of $50,000 to practice with. In addition to the real-time data, you will have complete access to all the tools and charts, just as you would in live trading.

👉 Traders must note that CFDs on shares are not offered via demo accounts per the regulations through ASIC or FSC. Neither are they offered through real accounts under the regulations of CySEC and FSA.

GO Markets Islamic Account

👉 Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

👉 This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

👉 GO Markets does not cater for Muslim traders who follow Sharia law and therefore does not offer an Islamic account or conversion option. If Muslim traders choose to use GO Markets, they must ensure that all positions are closed in time to avoid overnight fees.

How to open an Account with GO Markets in Tanzania

👉 To register an account with GO Markets, Tanzanian Traders can follow these steps:

➡️ Tanzanian traders can begin the process of registering a live account by clicking the “Open Live Account” button at the top right of the website. Your name, email address, birth date, and phone number will be required to create an account. Additionally, you will be prompted to choose a trading platform (either MT4 or MT5).

➡️ Next, you will be asked to provide your home address, as well as the currency you like to trade in and the status of your employment.

➡️ To become a customer of GO Market, you must provide proof of identification and proof of residence. Passports, national ID cards, driver’s licenses, and other forms of government-issued identification are all accepted at GO Markets. The GO Markets account holder’s entire name, current home address, issuance date, and issuing authority must be included in the proof of residence/address document.

➡️ Individual retail Tanzanian clients at GO Markets must agree to papers such as the GO Markets Disclosure Statement, GO Markets Terms & Conditions, and the GO Markets Privacy Policy to be approved as individual clients.

➡️ If necessary, GO Markets may provide personal information such as your name, date of birth, and address to a credit reporting agency (CRA) to determine whether such information matches data kept by the CRA on you.

GO Markets Vs NinjaTrader Vs ACY Securities – Broker Comparison

| 🥇 GO Markets | 🥈 NinjaTrader | 🥉 ACY Securities | |

| 📱 Trading Platform | ASIC, FSA Seychelles, FSC Mauritius, CySEC | NFA | ASIC, VFSC |

| 💵 Withdrawal Fee | • MetaTrader 4 • MetaTrader 5 | • NinjaTrader Desktop • NinjaTrader Mobile • CQG Mobile | • MetaTrader 4 • MetaTrader 5 |

| 💻 Demo Account | No | Yes | Yes |

| 💸 Min Deposit | Yes | Yes | Yes |

| 📉 Leverage | 320,000 TZS | 110,000 TZS | 110,000 TZS |

| 📊 Spread | Up to 1:500 | 1:50 | 1:500 |

| 💰 Commissions | From 0.0 pips | 1.1 pips | Variable, 0.0 pips |

| 🛑 Margin Call/Stop-Out | 80%/50% | None | 100%/50% |

| 📱 Order Execution | Instant | Instant, Market | STP |

| ✔️ No-Deposit Bonus | No | No | None |

| 💵 Cent Accounts | No | No | No |

| 💻 Account Types | No | No | • Brokerage Account • Cash Management Account • Brokerage and Cash Management • The Fidelity Account for Businesses • Fidelity Go, and several others |

| ⚖️ BoT Regulation | • Standard Account • GO+ Account | • Forex Account • Futures Account | • Standard Account • ProZero Account • Bespoke Account |

| 💰 TZS Deposits | No | No | No |

| ✔️ Tanzanian Shilling Account | No | No | Yes |

| 📞 Customer Service Hours | 24/5 | 24/5 | 24/5 |

| 🛍 Retail Investor Accounts | 2 | 2 | 3 |

| ☪️ Islamic Account | No | No | Yes |

| 💵 Minimum Trade Size | 0.01 lots | 0.01 lots | 1 lots |

| 📈 Maximum Trade Size | 250 lots | 100 lots | Depends on region and trading instrument |

| 📉 Minimum Withdrawal Time | Instant | Within 24 hours | 24 to 48 hours |

| 💸 Maximum Estimated Withdrawal Time | 1 to 3 business days | Between 5 to 7 working days | 5 to 7 working days |

| 💰 Instant Deposits and Instant Withdrawals? | Yes | No | Yes |

Min Deposit

USD 200 / 466 349 TZS

Regulators

Australian Securities & Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySec), Financial Services Commission (FSC)Financial Services Authority (FSA) & Securities and Commodities Authority (SCA)

Trading Desk

Hybrid

Crypto

Yes

Total Pairs

600+

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

GO Markets Trading Platforms

👉 GO Markets offers Tanzanian Traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

👉 GO Markets chose MT4 as their major trading platform since it is accepted as the industry standard for forex trading. Although MT4’s capabilities might vary from one broker to another because of the brokers’ unique ability to install various extensions, GO Markets picked MT4 as their trading platform.

👉 Because MT4 is the most widely used trading platform, it is available in both Mac and PC versions. If you are an aggressive trader, you will want one of these versions.

👉 A wide range of advanced features is available to you on GO Markets’ desktop platform, including substantial customization possibilities and an extensive variety of sophisticated tools, such as MT4 Genesis.

👉 A few unique features of MT4 NextGen include:

➡️ You can easily manage both your trades and your account from inside the MetaTrader Genesis interface itself.

➡️ A cutting-edge small terminal enables charts to be organized and trade management functions to be immediately accessed from inside the charts.

➡️ When looking for information about the market, several indicators may be employed.

➡️ An inventive correlation trader can detect prospective profit possibilities.

➡️ Tracking sessions in London, New York, Tokyo, and Sydney using an interactive session map

➡️ While the platform is still operational, the Market Manager window enables users to do other tasks.

MetaTrader 5

👉 MetaTrader 5, a more contemporary and updated version of the well-liked MT4 is also a part of GO Markets’ comprehensive offering. MetaTrader 5 has additional features on top of what is already included in MetaTrader 4 and features a more robust trading environment for Tanzanian traders.

👉 In addition, Myfxbook, a world-leading network with over 90,000 members, offers copy and social trading options that allow traders to follow or be followed by trading professionals for mutual benefit.

👉 Myfxbook AutoTrade is a global copy trading tool for members of the Myfxbook social trading community. With over a million users, it is easy to connect your GO Markets Standard trading account.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

👉 To cater to the needs of institutional traders, the MetaTrader 4 platform was built. When it comes to getting started, Tanzanian beginner traders will find that everything is laid out simply and is not too difficult to navigate.

👉 GO Markets and MetaTrader 4 provide traders with a user-friendly interface that makes it easy to navigate between various charts and periods.

MetaTrader 5

👉 MT5 is a user-friendly platform with a wide range of features. Maintains most of its functionalities, but adds a few new ones, such as automatic trading, copy trading, and more detailed price research.

👉 When it comes to market analysis, the in-built analytical tools of MT5 should provide excellent results. There are also no restrictions on the number of charts that Tanzanian traders can open at a single time.

👉 In addition, you can choose from 21 various timeframes when it comes to charting as opposed to fewer options provided by MT4.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4 and 5

👉 Both MT4 and MT5 are accessible on all mobile platforms, including tablet apps for your mobile device that run on either Android or iOS. All the trading activity is synchronized thanks to the fact that these platforms interface with the broker in the same manner that the desktop versions of the program do.

👉 Traders should note that there is a certain loss in functionality when compared to the desktop and the web-based trading platforms offered by MetaTrader 4 and MetaTrader 5.

👉 With the mobile platforms, Tanzanian traders can still cancel and alter existing orders, compute profit and loss, and trade on the charts, despite this reduction in functionality, which includes fewer charting choices and timeframes.

GO Markets Range of Markets

👉 Tanzanian Traders can expect the following range of markets from GO Markets:

➡️ Forex CFDs

➡️ Share CFDs

➡️ Index CFDs

➡️ Metal CFDs

➡️ Commodity CFDs

Financial Instruments and Leverage offered by GO Markets

| 🔨 Instrument | ✔️ Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 50+ | 1:500 |

| ➡️ Precious Metals | 2 | 1:100 |

| ➡️ Indices | 15 | 1:100 |

| ➡️ Stocks | 499 | 1:20 |

| ➡️ Energies | 4 | 1:30 |

👉 Contracts for Difference, more often referred to as CFDs, are a derivative trading product that allows Tanzanian investors to speculate on the direction in which the price of a financial instrument will move in the future. This offers traders in Tanzania the opportunity to profit from increasing as well as declining market conditions.

👉 You also have the option to trade on leverage, which enables you to maintain a bigger position while having to make a smaller initial deposit. However, margin trading has the potential to amplify not just your gains but also your losses.

👉 When contrasted with what is provided by the broker’s other companies, the variety of products that can be traded by GO Markets Ltd is limited, attributable to the fact that GO Markets Ltd. only operates in Europe.

👉 You will have access to more than 400 distinct shares coming from Australia, Hong Kong, and the United States if you use GO Markets Pty Ltd. GO Markets is an Australian company. Additionally, in addition to bitcoin contracts for difference, this trading arm of GO Markets provides investors with access to trade in genuine stocks.

Broker Comparison for Range of Markets

| 🥇 GO Markets | 🥈 NinjaTrader | 🥉 ACY Securities | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | No | Yes |

| ➡️️ ETFs | No | No | Yes |

| ➡️️ CFDs | Yes | No | Yes |

| ➡️️ Indices | Yes | No | Yes |

| ➡️️ Stocks | Yes | No | Yes |

| ➡️️ Cryptocurrency | No | No | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | No | Yes |

| ➡️️ Bonds | No | No | No |

GO Markets Trading and Non-Trading Fees

Spreads

👉 The spreads offered by GO Markets are modified per the trading account that is being utilized. Traders who use a Standard account will be subject to a wider spread but GO+ traders will be able to take advantage of interbank rates but will be charged a fee for each transaction they do.

👉 The following is a rundown of the typical spreads that traders might anticipate receiving from GO Markets:

➡️ AUD/USD – From 0.1 pips

➡️ USD/CAD – From 0.2 pips

➡️ EUR/USD – From as low as 0.0 pips with an average of 0.1 pips

➡️ USD/JPY – From 0.2 pips

➡️ USD/CHF – from 0.3 pips

➡️ GBP/USD – from 0.2 pips

Commissions

👉 Most of the pricing at GO Markets is structured into spreads, and as a result, the Standard account does not have any commission costs associated with it. As a result, the spread on the Standard Account begins at 1 pip, and it is the perfect choice for starting trading with the fewest potential complications.

👉 Nevertheless, the GO Plus Account is a choice for experienced traders or for those whose trading strategy needs reduced spreads that begin at 0.0 pips. Because of this, the following fees are charged to this trading account according to the base account currency:

➡️ Australian Dollar (AUD) – AU$3.00

➡️ Euro (EUR) – €2.00

➡️ Great British Pound (GBP) – £2.00

➡️ New Zealand Dollar (NZD) – NZ$3.50

➡️ United States Dollar (USD) – US$2.50

➡️ Singapore Dollar (SGD) – SG$3.50

➡️ Swiss Franc (CHF) – FR$2.50

➡️ Canadian Dollar (CAD) – CA$3.00

➡️ Hong Kong Dollar (HKD) – HK$20

Overnight Fees, Rollovers, or Swaps

👉 Traders from Tanzania who keep open positions for more than a day are subject to an overnight fee. The position taken by the trader will decide whether these charges are deducted from the total of the transaction or refunded (whether long or short).

👉 In addition, the fees are calculated using the prevailing interbank rates, the financial instrument being traded, the amount of the position being held, as well as the period during which the position is held.

👉 The following is a list of some samples of the overnight expenses that Tanzanian traders could anticipate spending when utilizing GO Markets:

➡️ EUR/CHF – -0.178 short swap and -0.073 long swap

➡️ EUR/USD – 0.085 short swap and -0.378 long swap

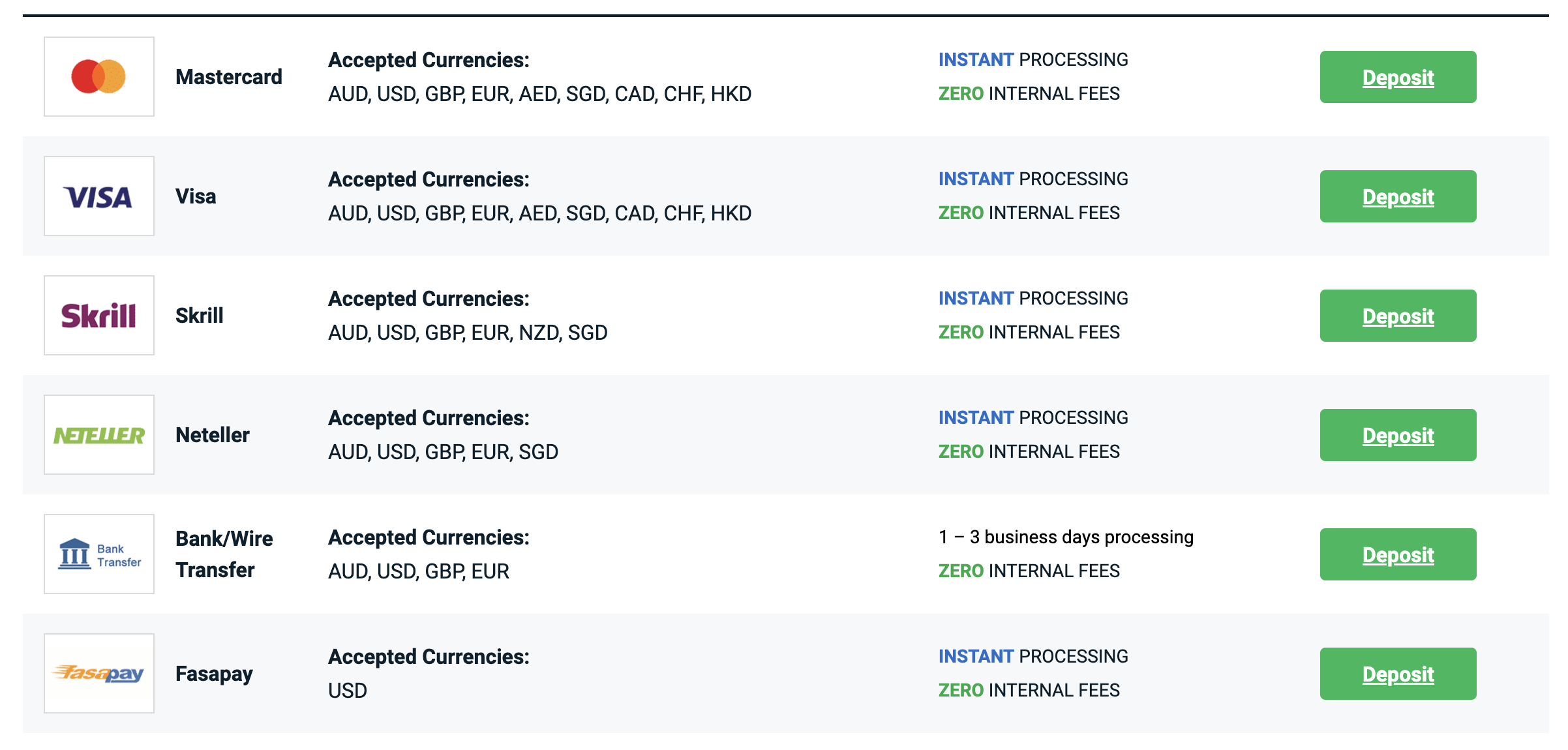

Deposit and Withdrawal Fees

👉 GO Markets does not charge customers any fees for making deposits or withdrawing money from their accounts. Traders from Tanzania need to be informed that, regardless of the method that they use to make deposits or withdrawals, their payment provider may charge them a processing fee.

Inactivity Fees

👉 GO Markets does not apply any fees or penalties on trading accounts that become dormant after an extended period of inactivity.

Currency Conversion Fees

👉 If Tanzanians deposit or withdraw funds with GO Markets in any currency other than their set base account currency, they will face currency conversion fees.

Min Deposit

USD 200 / 466 349 TZS

Regulators

Australian Securities & Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySec), Financial Services Commission (FSC)Financial Services Authority (FSA) & Securities and Commodities Authority (SCA)

Trading Desk

Hybrid

Crypto

Yes

Total Pairs

600+

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

GO Markets Deposits and Withdrawals

👉 GO Markets offers the following deposit and withdrawal methods:

➡️ Credit Card

➡️ Debit Card

➡️ POLi

➡️ Skrill

➡️ Neteller

➡️ Bank Wire Transfer

➡️ BPAY

➡️ Fasapay

Broker Comparison: Deposit and Withdrawals

| 🥇 GO Markets | 🥈 NinjaTrader | 🥉 ACY Securities | |

| Minimum Withdrawal Time | Instant | Within 24 hours | 24 to 48 hours |

| Maximum Estimated Withdrawal Time | 1 to 3 business days | Between 5 to 7 working days | Between 5 to 7 days |

| Instant Deposits and Instant Withdrawals? | Yes | No | Yes |

GO Markets Deposit Currencies, Deposit and Withdrawal Depositing Times

| 💸 Payment Method | 💵 Deposit Currencies | 💰 Deposit Processing | 💳 Withdrawal Processing |

| Credit Card | AUD, USD, GBP, EUR, NZD, SGD, CAD, CHF, HKD | Instant | Instant |

| Debit Card | AUD, USD, GBP, EUR, NZD, SGD, CAD, CHF, HKD | Instant | Instant |

| POLi | AUD | Instant | Instant |

| Skrill | AUD, USD, GBP, EUR, NZD, SGD | Instant | Instant |

| Neteller | AUD, USD, GBP, EUR, SGD | Instant | Instant |

| Bank Wire Transfer | AUD, USD, GBP, EUR, SGD, NZD, HKD, CAD, CHF | Instant | Instant |

| BPAY | AUD | Instant | Instant |

| Fasapay | USD | Instant | Instant |

How to Deposit Funds with GO Markets

👉 To deposit funds to an account with GO Markets, Tanzanian Traders can follow these steps:

➡️ To make a deposit Traders who are in Tanzania can access their accounts using the Client Portal provided by GO Markets.

➡️ They will have the ability to pick the way of depositing monies that best suits their needs here.

➡️ Traders may then go to the next stage after selecting the method of their choice for making deposits and entering the required amount of money to deposit.

➡️ Traders may confirm and finish the deposit by following any further instructions that are required by their payment provider. This may be done at any time. The completion of this stage is possible at the very end of the procedure.

GO Markets Fund Withdrawal Process

👉 To withdraw funds from an account with GO Markets, Tanzanian Traders can follow these steps:

➡️ To get the withdrawal process started, you will need to log in to the Client Portal and choose the “Withdrawal” option from the menu that appears when you do so.

➡️ Click the “Confirm” button once you have decided on the mode of withdrawal you want to use and entered the amount of money you wish to take out of your account.

GO Markets Education and Research

Education

👉 Customers of GO Markets have access to a dedicated education centre that offers a range of learning options aimed to help them in increasing their trading abilities regardless of the degree of expertise they already possess.

👉 Students are not required to pay a fee to access the many high-quality educational resources that have been compiled as part of the GO Markets education program. GO Markets is pleased to provide its customers with the following Educational Materials:

➡️ GO Trade Academy and introduction to forex

➡️ Educational courses and webinars

GO Trade Academy

👉 GO Markets and the GO Trade Academy provide free, high-quality, content-rich education to Tanzanian traders. Inexperienced and seasoned traders alike may benefit from these educational programs and courses, which cover a wide range of topics and provide a wealth of information.

👉 GO Markets’ mission in Forex and CFD trading is to help you learn more about the markets, sharpen your trading talents, and boost your self-esteem.

👉 A unique learning management system is used by the GO Trade Academy to keep track of your progress through the different courses and test your knowledge at key stages to help you recall the material that you have obtained.

👉 Courses include access to simulated trading platforms, assistance setting up accounts and using the platforms, as well as group coaching sessions via webinar.

Educational Courses and Webinars

👉 GO Markets offers educational courses that may help you learn trading knowledge and progress through the beginning, intermediate, and expert levels of the course curriculum.

👉 The Inner Circle is a group coaching program designed to enhance your knowledge and confidence via continued weekly instruction and market evaluations, while also facilitating networking with other traders. The purpose of the program is to make you a better trader in general.

👉 As you go through the many courses, which may cover topics that pique your curiosity, you will have the opportunity to give feedback and provide suggestions. Another advantage of the supplied educational courses is that they may be tailored to your unique requirements.

Research and Trading Tool Comparison

| 🥇 GO Markets | 🥈 NinjaTrader | 🥉 ACY Securities | |

| Economic Calendar | Yes | Yes | Yes |

| VPS | Yes | No | Yes |

| AutoChartist | Yes | No | No |

| Trading View | Yes | No | Yes |

| Trading Central | Yes | Yes | Yes |

| Market Analysis | Yes | Yes | Yes |

| News Feed | Yes | Yes | Yes |

| Blog | Yes | Yes | Yes |

👉 GO Markets offers Tanzanian Traders the following Research and Trading Tools:

➡️ AutoChartist

➡️ MT4 and 5 Genesis

➡️ VPS

➡️ a-Quant

➡️ Social Trading through MyFXBook

➡️ Trading Central

➡️ Daily News

➡️ Weekly Summaries

➡️ Articles

➡️ Economic Calendar

AutoChartist

👉 GO Markets customers with a minimum account balance of 6,100 BWP or $500 are eligible for the AutoChartist trading program, which provides real-time trading alerts, price movement indications, volatilities, and events. It is one of the most popular charting programs for MT4 and MT5.

MT4 and 5 Genesis

👉 For the last 10 years, GO Markets has developed a set of key MetaTrader add-ons to help traders make trades, manage risk, and find trading opportunities. This led to the creation of MetaTrader Genesis, which is a complex add-on for MT4 and MT5.

👉 It is a full collection of trading tools that can be used as expert advisors to enhance the functionality of your MetaTrader platform.

VPS

👉 GO Markets offers clients a virtual private server (VPS) that enables them to access the MT4 and MT5 platforms remotely around-the-clock without the need to switch on their own computers. Traders in Tanzania with a sluggish Internet connection or who must run expert advisors around the clock may profit the most from this function.

👉 If you utilize the GO Markets VPS solution, you will have direct access to market liquidity since it is physically located near the location where many transactions occur.

👉 If you have a minimum monthly trading volume comparable to about 5 round turn lots, you may qualify for a free VPS subscription. If the minimum monthly volume is not met, a service charge starting at $10 will be assessed.

a-Quant

👉 As pioneering minds with a combined experience of over 25 years in the financial technology business, the traders at a-Quant have developed innovative trading tools using that knowledge. They have developed a one-of-a-kind signal service by making use of techniques such as machine learning, artificial intelligence algorithms, sentiment analysis, and technical analysis.

Social Trading through MyFXBook

👉 Myfxbook AutoTrade is a tool that is available to clients of GO Markets who have a balance of at least 2,000,000 TZS or an equivalent to $1,000 in their accounts.

👉 AutoTrade is a service that allows you to clone other people’s trades onto your own account, making it a widely used service across the world.

Trading Central

👉 As a result of their cooperation with Trading Central, GO Markets can give you pattern recognition software that may enhance your whole trading experience.

👉 Trading Central is a collection of tools that are fully compatible with both MetaTrader 4 and MetaTrader 5. Trading Central offers 24-hour coverage of several assets, in-depth technical and fundamental analysis, and historically proven trading strategies.

Daily News

👉 On its website, GO Markets has a section that is completely dedicated to providing coverage of the most current market news. It is constantly updated using expert research, and it covers a wide variety of marketplaces while also providing an in-depth analysis of each.

Weekly Summaries

👉 Weekly insights into important financial developments from around the globe that potentially impact the trading operations of Tanzanian traders are provided by GO Markets in the weekly summaries that are made available to all traders.

Articles

👉 A distinct portion of the GO Markets website is devoted to regular articles that discuss the global financial industry. These articles describe events that may impact financial markets, making them a significant resource for Tanzanian traders that do fundamental research.

Economic Calendar

👉 On the GO Markets economic calendar, the most current economic data releases are presented along with the release date and time, the country from whence they came, an impact rating, and the actual, predicted, and past results.

👉 The calendar can be filtered according to your preferences, which is an essential tool for basic analysis.

Margin Call Podcast

👉 GO Markets has recently introduced Margin Call podcasts, a new audio series that gives you an inside view of the Forex and CFD markets. In recent episodes, the Neuralle Media-produced GO Markets crew interviews the those who keep the program operating, with Jordan Michaelides acting as a guest host.

👉 Tanzanian traders who are interested in this podcast can find it on:

➡️ Google Podcasts

➡️ Spotify

➡️ PCA

➡️ Podbean

➡️ Overcast FM

GO Markets Bonuses and Promotions

👉 GO Markets does not currently offer any bonuses or promotions to Tanzanian traders.

How to open an Affiliate Account with GO Markets

👉 To register an Affiliate Account, Tanzanian Traders can follow these steps:

➡️ Find the option at the top of the GO Markets webpage under “Affiliates”.

➡️ Affiliates can begin the process by clicking the green “Sign Up Now” banner on a new page that will appear.

➡️ Residents of Tanzania may begin the process of becoming an affiliate by filling out the online form.

➡️ The applicant will be notified whether they have been approved or refused after the form has been completed and GO Markets has received it.

👉 When applying to become a GO Markets Affiliate, the broker considers the following factors:

➡️ The industry in which the potential affiliate is involved.

➡️ Whether the proposed affiliate must be a regulated company.

➡️ To determine whether there is any misleading or fraudulent information on the potential affiliate’s media platform.

➡️ The overall brand or reputation in the market and/or industry of the potential affiliate.

👉 GO Markets Account Managers will be the main point of contact for new affiliates. KYC and/or identity papers must be submitted to complete the application of the potential affiliate after the application has been authorized.

👉 Following approval, the affiliate will be subject to ongoing supervision, including yearly assessments of its media outlets and platforms.

GO Markets Affiliate Program Features

👉 The GO Markets Group (GO Markets) includes GO Markets Pty Ltd and its affiliated companies and subsidiaries, all of which have licenses and meet standards in the various countries where they provide trading services.

👉 The GO Markets Affiliate Program has a few benefits, such as:

➡️ A well-regulated and trusted trading environment

➡️ On-going market-leading commissions

➡️ Excellent support

➡️ Marketing materials that include banners, links, and widgets

Min Deposit

USD 200 / 466 349 TZS

Regulators

Australian Securities & Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySec), Financial Services Commission (FSC)Financial Services Authority (FSA) & Securities and Commodities Authority (SCA)

Trading Desk

Hybrid

Crypto

Yes

Total Pairs

600+

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

GO Markets Customer Support

👉 GO Markets can be contacted during market hours between Mondays and Fridays. In addition, GO Markets offers multilingual, prompt, and helpful customer support over several communication channels.

| Customer Support | GO Markets’ Customer Support |

| ⏰ Operating Hours | 24/5 |

| 🗣 Support Languages | English, Vietnamese, Indonesian, Arabic, Thai, Portuguese, Chinese, Spanish |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| 📞 Telephonic Support | Yes |

| ✔️ Local Support in Tanzania? | No |

| 🥇 Overall quality of GO Markets Support | 4/5 |

GO Markets Corporate Social Responsibility

👉 GO Markets does not currently indicate any information on its Corporate Social Responsibility (CSR) initiatives or projects.

Our Verdict on GO Markets

👉 GO Markets is widely regarded as the most successful forex broker in Australia. A demo account, superior customer support, Trading Central, AutoChartist, Metatrader 4, and a variety of additional trading tools are all available via GO Markets, giving Tanzanians a plethora of trading options and advantages in the financial markets.

👉 GO Markets provides a diverse selection of trading platforms, so Tanzanian traders can easily choose the one that best suits their needs.

👉 In addition to this, it is easy to sign up for an account, and GO Markets accepts a variety of different payment methods for both deposits and withdrawals, with the benefit that there are no additional fees charged on deposits or withdrawals.

GO Markets Pros and Cons

| ✔️ Pros | ❌ Cons |

| GO Markets is known for its competitive spreads | There is a limited choice between accounts as GO Markets only offers two accounts |

| There are low commission charges on Share CFDs | Tanzanians are not given the option to register a trading account with TZS as the base account currency |

| There are no inactivity fees charged on dormant accounts | There is a high minimum deposit required on both account types offered by GO markets |

| There are no fees charged on any deposit or withdrawal methods | There is no Swap-Free Islamic account option |

| There is a decent range of markets that can be traded | |

| GO Markets offers excellent market analysis and additional trading tools and resources | |

| There are several trading opportunities offered to traders, including social and copy trading through Myfxbook | |

| There is a demo account offered to both beginner and experienced traders |

FAQ

Is GO Markets regulated?

Yes, GO Markets is regulated by one Tier-1 Regulator namely the ASIC in Australia, one Tier-2 regulator namely CySEC in Cyprus, and two Tier-3 regulators namely the FSC in Mauritius and FSA in Seychelles.

Is GO Markets safe or a scam?

GO Markets is a safe broker. GO Markets complies with the rules set out by a few of the industry’s most reputable authorities. This involves supervision by organizations like CySEC in Cyprus, ASIC in Australia, FSA in Seychelles, and FSC in Mauritius.

Is GO Markets good for beginners?

Yes, GO Markets can be a good broker for beginners. However, although there is a wealth of information and assistance available on the trading platform to enable novice traders, the platform is designed with experienced traders in mind.

Does GO Markets have Nasdaq?

Yes, GO Markets offers a range of Index CFDs which include Nasdaq.

What is the withdrawal time for GO Markets?

The withdrawal time is between instant on most withdrawal options up to three days where bank wire is concerned.

How do I deposit in a GO Markets trading account?

You can log into your client portal to find a wide variety of deposit options including bank wire transfer, Skrill, Neteller, and several others.

Does GO Markets offer a demo account?

Yes, GO Markets offers a demo account that can be registered on either the Standard or GO+ Accounts and both trading platforms that are offered.

What is the minimum deposit for GO Markets?

The minimum deposit for both the Standard Account and GO+ Account is 320,000 TZS or an equivalent of AU$200.

Does GO Markets have Volatility 75?

No, GO Markets does not have Volatility 75 (VIX) as part of its comprehensive tradable product portfolio currently.

Conclusion

👉 Now it is your turn to participate:

➡️ Do you have any prior experience with GO Markets?

➡️ What was the determining factor in your decision to engage with GO Markets?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with GO Markets such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

👉 Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

👉 No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.